The repercussions of the trade dispute with the US have been limited so far, but several US-export dependent SMEs could fail should the dispute continue.

- The repercussions of the Sino-US trade dispute are limited so far

- Payments take between 60 and 90 days on average

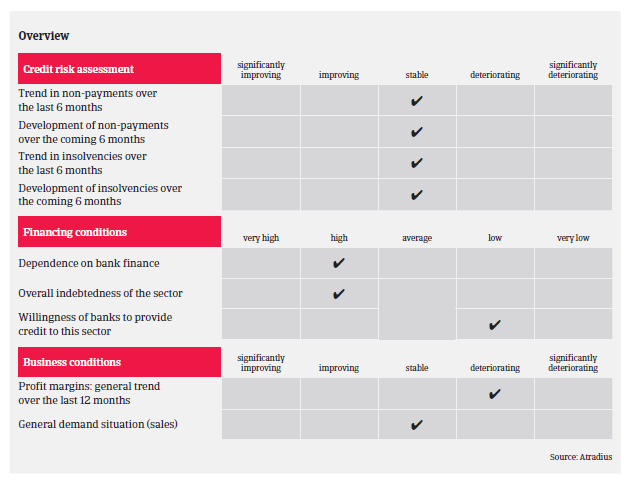

- Lending conditions remain very tight

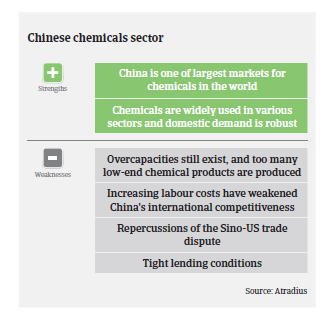

The Chinese chemicals industry has entered a phase of lower but still solid growth, following the slowdown in GDP expansion, which is forecast to increase 6.3% in 2019 and 6.0% in 2020. Growth rates of both Chinese GDP and chemicals demand remain above the global average. The industry also benefits from infrastructure projects abroad in the context of the “Belt and Road Initiative”.

China's chemicals export volume accounts for just about 10% of sector output. The direct effect of US import tariffs on the industry is rather limited, as chemical deliveries to the US are low in value and volume terms. However, the impact is higher for suppliers of chemicals to Chinese export-driven industries (e.g. toys, textiles, etc.), which are deeply affected by US punitive tariffs.

Due to higher downstream demand and increased sales prices, net profit in the industry increased 30% in 2018, to CNY 900 billion. However, profit margins of chemicals businesses are expected to deteriorate in the coming months, due to higher oil price volatility and increased prices for commodity imports from the US and other countries.

In order to retaliate to US tariffs, China originally imposed a 10% tariff on liquefied natural gas (LNG) imports from the US, increasing it to 25% in June 2019. The majority of US oil and gas is imported by large state-owned enterprises like Sinopec, PetroChina and CNOOC, which are largely able to cope with increased import costs, and can count on subsidies provided by the government.

In the Chinese chemicals industry both indebtedness and dependence on bank financing are high, while the lending policy of banks is restrictive for private-owned companies. Banks prefer to offer loans to state-owned enterprises or syndicate loans provided by the government.

On average, payments in the Chinese chemicals sector take around 60-90 days. The level of payment delays and insolvencies is average compared to other industries, and no major increase in business failures is expected in 2019, as demand for chemical products is relatively stable across all subsectors and among all buyer segments.

However, we can’t rule out the possibility of several US-export dependent SMEs failing should the trade dispute continue or escalate further. At the same time, supply side reforms and stricter environmental policies in China will continue to force inept and weak players out of the market.

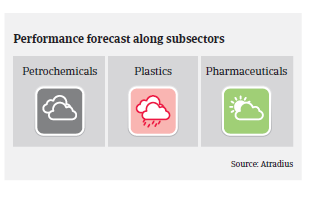

Our underwriting approach to the Chinese chemicals sector is generally neutral for most main subsectors (basic chemicals, petrochemicals, and fine and specialty chemicals). Their business performance remains steady, with increased use of advanced technology in order to produce higher quality products. In the agrochemical sector the issue of overcapacity has been successfully tackled by government measures to adjust the market and to increase environmental protection.

However, downside risks remain, such as an escalation of the trade dispute leading to a serious economic slowdown and poor stock market performance hitting share prices of listed companies. We are more cautious with highly geared private chemicals businesses, as banks are currently restrictive in offering loans to privately owned companies. We are also more conservative in our approach to chemicals commodity traders, due to very low profits in this segment and ongoing price volatility.

Our underwriting stance for the plastics subsector is restrictive, as there are many small players active in this segment, and the majority of products are still low-end. Plastics is the chemicals segment mainly affected by the Sino-US trade dispute, directly or indirectly (as suppliers to businesses dependent on exports to the US). Regarding plastic businesses exporting to the US we scrutinize financial strength, export share and if the goods are on the tariff list or not. The long-term trend for the segment seems to be more positive, as output is moving up the value chain.

Our underwriting stance for pharmaceuticals is open as domestic demand is robust, while most of the players active in the market are state-owned enterprises.

When underwriting the chemicals/pharmaceuticals industry we take into consideration the performance of each subsector, the background of the businesses’ shareholders, the nature of the buyer (seller or manufacturer), their financial performance and funding facilities.

Documentos relacionados

826KB PDF