Payment delays remain a major issue in the British construction industry, while in Belgium the payment behaviour of the public sector remains bad.

European Football Championship 2016

Sector playing field: construction industry

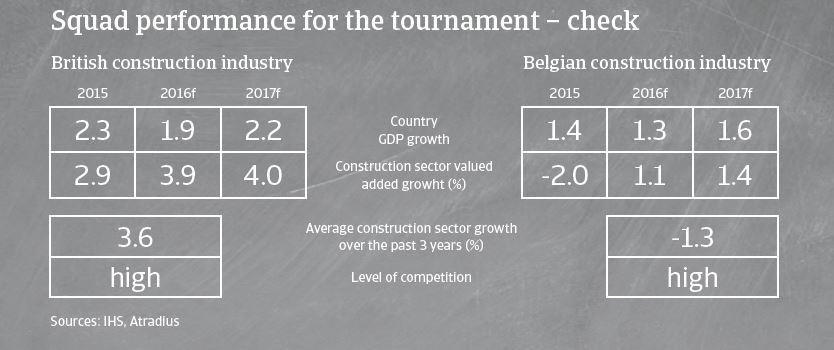

Wales/United Kingdom: building performance does not match the success on the pitch

The UK construction sector accounts for more than 6% of British GDP, and employed 2.1 million people in 2015. The industry suffered heavily after the 2008 credit crisis, but has rebounded since 2013. Despite the recovery in output, construction is still affected by trailing effects of the past recession. This became evident in H1 of 2015, when construction insolvencies increased steeply. Some larger business failures had a knock-on effect, causing their suppliers and sub-contractors to go bust due to large sums of monies owed.

The on-going problems are particularly noticeable in the tendering process, as during the downturn, construction companies took on contracts at conditions that were no longer sustainable in 2014 and 2015, mainly due to raw material price increases and higher labour costs. As many construction businesses are still working on such low margin legacy contracts, losses on contracts are still relatively frequent despite improving order books.Belgium: subdued performance, in constrast to the 'Red Devils' performance so far

The rebound of the Belgian construction sector remains slow, as the industry is still underperforming compared to the rest of the economy. Since the end of 2011, 20,000 construction jobs have been lost, down to about 200,000 by the end of 2015.

Belgian construction businesses suffer from high labour costs, especially when compared to construction businesses from Eastern Europe active in Belgium. Public initiatives to restrict unfair competition from foreign businesses and to reduce domestic labour costs in order to increase competitiveness had no real success so far. Construction output is expected to grow by just about 1% in 2016, and pressure remains on businesses´ profit margins.

Players to watch

Wales/United Kingdom

Due to the upward trend in construction output since 2013/2014, builders are now able to be more selective in choosing which contracts to tender, and therefore have more influence on payment terms. However, this is somehow counteracted by increased labour and material costs, which have a negative effect on businesses’ margins.

Construction businesses highly dependent on the UK solar sector are threatened by a major downturn after the government decided to cut the Feed-In Tariff by more than 80%. Insolvencies have already increased in this segment since the end of 2015.

Belgium

Prospects for renovation businesses are rather positive, with orders showing an increasing trend due to the aged real estate stock in Belgium.

Perspectives in the new residential construction segment remain subdued, with the number of permits for residential buildings recording a year-on-year decline in 2015. Most construction companies in this segment expect a decrease in the construction and completion of new buildings in 2016.

In the non-residential construction sector, a year-on-year decrease in the number of permits was recorded in 2015. Government investment remains low compared to the European average. Infrastructure building is still facing decreasing order books and prices. The public tendering business seems to be most affected in Wallonia.

Major strengths and weaknesses

British construction industry: strengths

Belgian construction industry: strengths

- Further construction output growth expected in 2016 and 2017

- Volumes are increasing across all segments

- Demographic evolution

- Aged real estate stock, need for infrastructure improvements (e.g. schools, hospitals, roads)

- Current low interest rates

British construction industry: weaknesses

Belgian construction industry: weaknesses

- Late payments in the sector

- Access to bank finance remains difficult for many smaller businesses or businesses subject to unattractive terms. This lack of funding affects SMEs that may need to resume investment, particularly in capital expenditure to cope with a growing market.

- Raw material cost inflation and lack of skills, now evident as work volumes pick up.

- Supplier support remains a big problem for those further down the supply chain.

- Competition from foreign builders

- Still low level of government investment

- High labour costs

Fair play ranking: payment behaviour and insolvencies

British construction industry

Late payments remain a major issue in the industry, especially from Tier 1 contractors, who have issues with legacy contracts themselves.

Non-payment notifications showed an increasing trend in 2015, and remain high in 2016.

Construction insolvencies are expected to level off in 2016 after an increasing trend in 2015.

Belgian construction industry

Payment terms of “60 days end of month” remain very common in the sector. However, some construction contractors (mainly large businesses) are trying to solve their liquidity issues by extending their payment terms even longer when paying their subcontractors.

Payment behaviour of public bodies remains bad, and it is still quite common that businesses ask suppliers for longer payment terms if they themselves are waiting for overdue payments from public bodies.

Overall, we observed an increase in payment delays in 2015. Given the difficult market conditions, the number and value of notifications of non-payments is expected to remain high.

In 2015, construction insolvencies decreased 8% year-on-year. It is expected that business failures decrease further in 2016, although at a slower pace. Despite the previous decreases, the overall level of construction insolvencies remains high, given the steady increases seen in the years 2008-2013.

Documentos relacionados

3.01MB PDF