Economic growth in Belgium is expected to slowdown to 1.2% this year and in 2020.

Domestic demand is forecast to be the main driver of economic growth, while net exports are expected to continue to be adversely impacted by the current slowdown in world trade, as well as by weaker economic growth in the main trading partners of Belgium. Against this backdrop, insolvencies are expected to increase significantly in 2020.

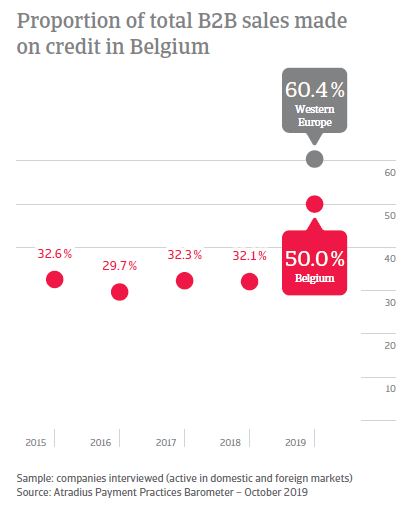

Belgium trades more on credit terms with their B2B customers than one year ago

Based on survey results in Belgium, 50% of the total value of the respondents’ B2B sales was transacted on credit (up from 32.1% last year). This is well below the 60.4% regional average. The increased use of trade credit in B2B transactions of Belgian respondents seems to be in line with the sustained domestic demand. It also matches the perceived need to remain competitive on export markets, particularly now that the slowdown in both global trade and in the growth of Belgium’s main trading partners is weighing heavily on the country’s net exports.

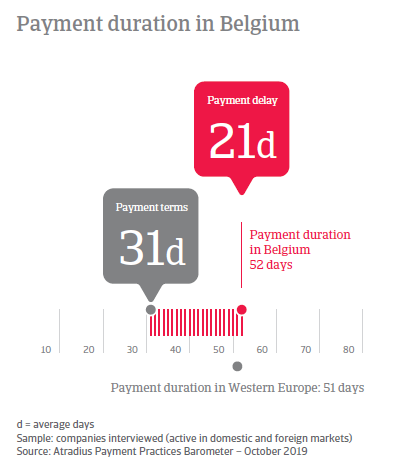

Belgian B2B customers are given longer than last year to pay invoices

In addition to being more likely to offer customer credit than one year ago, respondents in Belgium set looser payment terms for their B2B customers. Based on survey findings, most respondents (78%) requested payment from customers on average 31 days from invoicing (longer than the average 26 days of last year). These are below the 34 days average for Western Europe.

In Belgium, dunning is the most often used credit management technique

Survey findings in Belgium show a balanced mix of credit management techniques used by respondents to protect their receivables from the risk of B2B payment default. Within this mix, dunning (outstanding invoice reminders) appears to be the most frequently used technique (29% of respondents, in line with the percentage of respondents at regional level). The assessment of the credit ability of prospective buyers, prior to any trade credit decision, follows suit (23% of respondents, below the 35% in the region). A standout finding is that fewer respondents in Belgium (18%), than in Western Europe (24%) build funds to protect against potential bad debt.

Despite tighter credit management, invoice-to-cash turnaround is not significantly quicker than one year ago

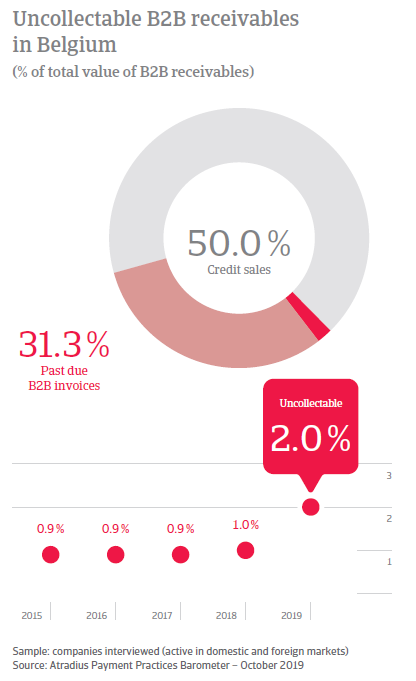

31.3% of the total value of the B2B invoices issued by respondents in Belgium over the past year remained unpaid at the due date. This is above the 28.9% average for Western Europe. Despite improved payment practices from B2B customers, resulting in increased timely payments (65% of invoices paid on time compared to 56% last year), respondents in Belgium do not turn overdue invoices into cash significantly earlier than last year (52 days down from 54 days). This variation is in line with survey findings for the region overall, where payment duration decreased on average to 51 days down from 57 days last year.

More respondents in Belgium than in Western Europe reported their businesses to be hit hard by late payments

Despite using a balanced mix of credit management techniques to protect their business, far fewer respondents in Belgium (36%) than in Western Europe (42%) reported no significant impact on business arising from late payments from customers. Late invoice settlement caused 28% of Belgian respondents to pay their suppliers late. This percentage is in line with regional levels. In contrast, more respondents in Belgium (24%) than in Western Europe (20%) reported they needed to pursue additional financing from external sources to make up for liquidity issues arising from untimely settlement of invoices. Compared to the same survey period one year ago, respondents in Belgium seem to be less successful when it comes to the collection of long-term past due invoices. Survey findings highlight a doubling in the proportion of write-offs of uncollectable accounts, amounting to 2% of the total value of B2B invoices (up from 1% last year). This compares to the 2.2% average for Western Europe. Lower efficiency in collection of overdue receivables can severely affect businesses and impact profits.

More respondents in Belgium than in Western Europe expect B2B customers’ payment practices to worsen over the coming months

52% of survey respondents in Belgium (55% in Western Europe) believe their B2B customers’ payment practices will not significantly change over the coming months. In contrast, more respondents in Belgium (31%) than in Western Europe (25%) expect their B2B customers’ payment behaviour to deteriorate over the same period. The expected deterioration is forecast to result in an increase in the proportion of overdue invoices. To strengthen their receivables management and protect business profitability against trade credit risk, 31% of Belgian respondents plan to perform dunning activities more often, 28% will monitor buyers’ credit risk and 28% will engage a collections agency. More respondents in Belgium (30%) than in Western Europe (25%) believe that access to bank financing will be more troublesome over the coming months. Among respondents who share this opinion, 37% (above the 30% at regional level) plan on reacting to tighter financing conditions by reducing the workforce through layoffs or hire freezes. For 33% of Belgian respondents (same as at regional level) more difficult access to bank financing will cause delay in business investment.

Overview of payment practices in Belgium

By business sector

B2B customers in the Belgian construction sector are given the longest period to settle invoices

Based on survey findings in Belgium, B2B customers of respondents from the construction sector are given the longest payment terms, averaging 35 days from invoicing. Average payment terms across the other sectors surveyed in Belgium range from 32 days in the machines sector, to 21 days in the ICT/electronics sector.

Trade credit risk worsened in the Belgian transport sector over the past year

The machines sector in Belgium is the hardest hit by late payments from B2B customers, with an average of 40% of the total value of invoices still unpaid at the due date. Across the other sectors surveyed in the country, the percentage of overdue invoices ranges from an average of 38% in the ICT/electronics sector to 24.2% in the agri-food sector. Credit risk increased in the Belgian transport sector over the past year, due to a sizeable deterioration in timely payments (59.8% of invoices paid on time compared to 63.5% last year).

Both the agri-food and machines sectors in Belgium record the highest proportion of write-offs

Both the agri-food and machines sectors in Belgium recorded the highest proportion of B2B receivables written off as uncollectable (2.5% each). Across the other sectors surveyed in the country, the average proportion of uncollectable B2B receivables range from 2.2% in the consumer durables sector, to 1.7% in the transport sector. This is in line with the deterioration of trade credit risk observed in the sector.

By business size

Large enterprises in Belgium granted the longest average payment terms for B2B customers

Respondents from large enterprises in Belgium extended the longest payment terms to B2B customers, averaging 58 days from invoicing. Micro enterprises offered average payment timings at 25 days, and SMEs at 31 days.

B2B customers of Belgian large enterprises pay invoices far more slowly than one year ago

B2B customers of Belgian SMEs improved how quickly they paid invoices. The proportion of invoices paid on time increased to 64.9%, up from 51.2% one year ago. Owing to this improvement, respondents from Belgian SMEs are now able to collect overdue invoices significantly quicker than last year (on average within 50 days from invoicing down from 59 last year). In contrast, respondents from micro enterprises recorded longer invoice-to-cash turnaround timings (on average after 50 days from invoicing, up from 42 days last year). This is the case for respondents from large enterprises as well, who were able to cash in overdue payments far later than one year ago, on average 72 days from invoicing, up from 51 last year.

Belgian SMEs took the longest to collect long overdue receivables

With an average of 2.1% of B2B invoices written off as uncollectable (up from 1.3% last year), SMEs in Belgium appear to be the slowest when it comes to collecting long overdue payments (over 90 days past due). This despite the significant improvement in the invoice-to-cash turnaround timings commented earlier on. Large enterprises write off 1.9% of receivables as uncollectable. For micro enterprises, this is 1.7% (each up from less than 1% last year).

Christophe Cherry, Atradius Country Director for Belgium commented on the report: “Insolvencies in the eurozone are expected to rise 1.2% this year. The outlook for 2020 remains subdued, due to a substantial slowdown of economic growth negatively impacting the manufacturing sector. Additionally, uncertainties around global trade policies weigh heavily on business confidence and investment growth, which when combined with the economic slowdown result in increasing financial risks.

As the Belgian survey highlights, supporting domestic demand and export flows in such a difficult trade environment is achieved through a more frequent use of trade credit and a relaxation in the timings of invoice settlement. However, the latter increases the risk of payment default from customers, particularly from those in riskier markets. Businesses interviewed in Belgium are well aware of this, and express concern over the predicted deterioration of their customers’ payment practices in the coming months. Despite their sharp focus on credit management, however, survey findings reveal that they were not able to turn overdue payments into cash significantly quicker than last year.

This shows that it is getting more complex to perform a solid assessment of the credit risk connected to selling on credit. Miscalculation could result in serious cash flow problems, negatively affecting companies of any size. A strategic approach to credit management, therefore, is essential to grow the business while at the same time ensuring a stable cash flow.”