The percentages of B2B sales on credit terms in Denmark (56.4%) are, as in previous years, significantly higher than in Western Europe overall (38.8%).

The Danish economy is expected to grow 1.7% in 2017 spurred by improved investment and growing exports. Despite this positive outlook, Danish respondents seem to have become more risk averse in respect to using trade credit with their domestic and foreign B2B customers.

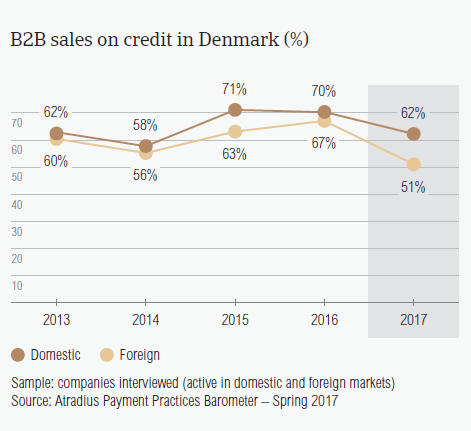

Sales on credit terms

With an average of 56.4% of the total value of B2B sales transacted on credit terms, Denmark remains the Western European country most inclined to use this method of payment. However, in 2017 Danish respondents sold less on credit terms.

- The 2017 proportion of domestic B2B sales on credit (62.1%) decreased by almost eight percentage points. This follows a marginal decrease in 2016 and seems to underline a downward trend on the domestic market (2016: 70.4%; 2015: 71%).

- Danish respondents reported that 50.7% of their sales to foreign B2B customers was made on credit. This compares to 67% in 2016 and 63% in 2015.

The percentages of B2B sales on credit terms in Denmark are, as in previous years, significantly higher than in Western Europe overall (Western Europe: domestic 42.6%; foreign: 35.1%).

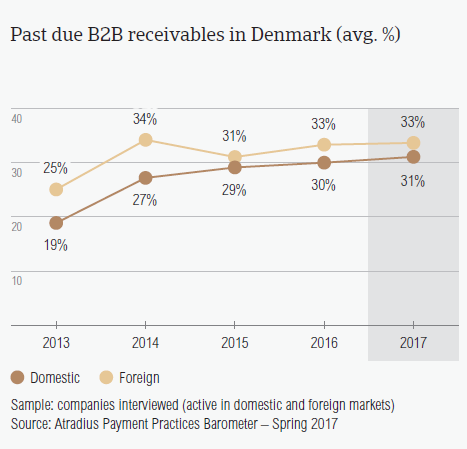

Overdue B2B invoices (%)

Danish respondents reported having experienced late payment from their B2B customers more frequently in 2017 than one year ago.

- The percentage of Danish respondents (87.4%) reporting late payment from their B2B customers is slightly lower than the regional average (87.8%) and has increased compared to 2016 (82.1%).

- Less than half of the invoices of respondents in Denmark (32.3%) remained outstanding past the due date.

- Compared to 2016 (domestic: 29.8%; foreign: 33.1%), the average percentages of overdue invoices in Denmark increased (domestic: 31.4%; foreign: 33.2%).

- The Days Sales Outstanding (DSO) figure posted by respondents in Denmark is one of the lowest among the countries surveyed. In 2017, this averages 33 days (2016: 32 days) and is far below the average of Western Europe (44 days).

- Asked about future expectations in their average annual DSO, the majority of Danish respondents (71.5%) foresee no changes. 17% of respondents said they expect a slight increase, while 7.5% a slight decrease.

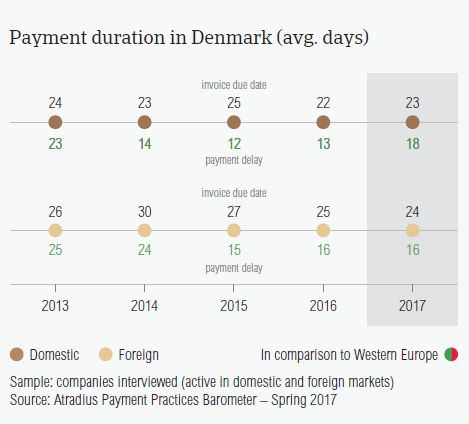

Payment duration (average days)

Along with their peers in Great Britain (23 days), the Netherlands (24 days) and Germany (24 days), Danish respondents (24 days) offer some of the shortest average payment terms.

- The average payment terms given to domestic and foreign B2B customers by Danish respondents are very similar (domestic: 23; foreign: 24 days).

- Compared to 2016, there were only minor differences in the average payment terms extended to both domestic customers (one day longer to settle invoices) and foreign customers (one day less).

- Consistent with the survey pattern, payments on the Danish domestic market were slower this year. Danish respondents reported that they waited, on average, 18 days after the due date to receive payments. This is five days longer than the average observed in our 2016 survey.

- The average payment delay by foreign B2B customers stood at 16 days, which means there was no change compared to the previous year.

- Based on these changes, Danish respondents turn overdue receivables into cash in an average of 41 days from invoicing (they need three days longer than in 2016).

Key payment delay factors

According to Danish respondents, late payment was mostly due to buyers’ use of outstanding invoices as a form of financing and the complexity of the payment procedure.

- Similarly to what was observed last year, the main reasons for payment delays by domestic and foreign B2B customers of respondents in Denmark were the buyers’ use of outstanding invoices as a form of financing (domestic: 42.2%; foreign: foreign: 34.2%) and the complexity of the payment procedure (domestic: 27.2%; foreign: 37.7%).

- Liquidity issues – the main reason for payment delays cited by respondents in Western Europe, (domestic: 52.6%; foreign: 34.5%) seems to be experienced significantly less often with respondents in Denmark (domestic: 21.4%; foreign: 11.4%).

- Most respondents in Denmark (53.7%) stated that overdue payments did not impact their business significantly. This compares to a lower percentage of 43.9% of respondents expressing this in Western Europe.

- 17.2% of Danish respondents, however, said that due to late payments, they needed to take specific measures to correct cash flow.

Protection of business profitability

Less than 10% of Danish respondents stated that they intend to do more to protect themselves against the potential impact of Brexit, the slowdown in Asia and US protectionism.

- When asked about increasing protection in respect to the above-mentioned developments, 45.2% of Danish respondents said that they do not intend to make changes to their current mix of credit management tools (Western Europe: 48.3%).

- For 9.3% of Danish respondents, the potential impact of Brexit, the slowdown in Asia and US protectionism are reasons to take more action (Western Europe: 18%).

- Respondents from Denmark are far less likely to increase checks of their buyers’ creditworthiness (12.5%) and monitor buyers’ credit risk more often (12.3%) than their peers in Western Europe (23.5% and 19% respectively).

- Danish respondents plan a similar approach in respect to all three developments when it comes to monitoring buyers’ credit risk (Brexit: 11.7%, slowdown in Asia: 12.5%, US protectionism: 13.4%). However they are less inclined to monitor buyers’ credit risk more often when it comes to Asia (Brexit: 15.3%, slowdown in Asia: 9%, US protectionism: 12.6%).

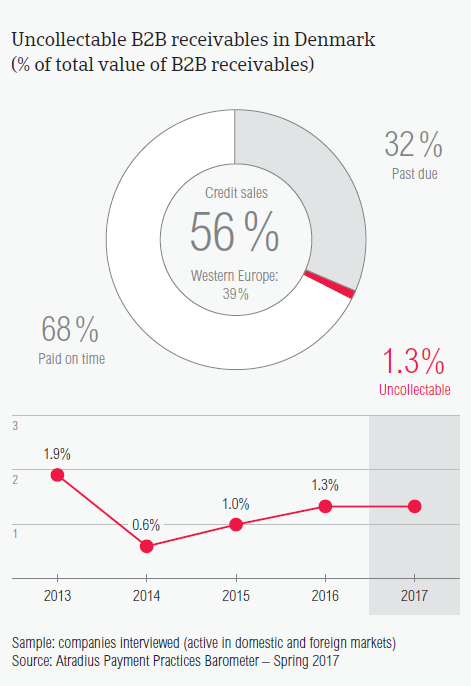

Uncollectable receivables

With 0.6% of the total value of B2B receivables written off as uncollectable, Denmark’s average of uncollectable receivables is consistent with the regional average.

- There were no changes compared to the percentage of uncollectable receivables observed last year.

- Similarly to what was observed in 2016, uncollectable receivables consisted mainly of domestic write-offs (domestic: 1%; foreign: 0.3%).

- In 2017, the largest proportion of uncollectable receivables originated from the chemicals, construction and consumer durables industries.

- The main reasons why B2B receivables were uncollectable were the customers’ bankruptcy (57.4%), the old age of the debt (31%) and the high costs of pursuing debtors (25.2%).

Payment practices by industry

Most respondents in Denmark (67%) do not expect a change in the payment behaviour of their domestic and foreign B2B customers over the coming 12 months.

- The average payment terms offered to B2B customers of Danish respondents in the paper (25 days), machines (32 days), chemicals (32 days) and electronics industries (38 days) are longer than the 24 days average for the country.

- At the other end of the scale, B2B customers in the agriculture (average payment terms: 14 days), services (17 days) and business services (17 days) sectors are asked to pay their invoices faster.

- In 2017, B2B customers in the services (on average, payment 81 days after the due date), business services (71 days), and consumer durables (68 days) sectors took the longest to pay.

- The main reasons for the delays in the above-mentioned sectors were the buyers’ use of outstanding invoices as a form of financing (chemicals: 54%; services: 52% and business services: 50%) and the complexity of the payment behaviour (business services: 34%, consumer durables: 25% and services: 20%).

- Looking ahead, 26% of Danish respondents (19%) than respondents, as many as in Western Europe overall, believe that there might be a slight deterioration in the payment behaviour of their B2B customers over the coming 12 months.