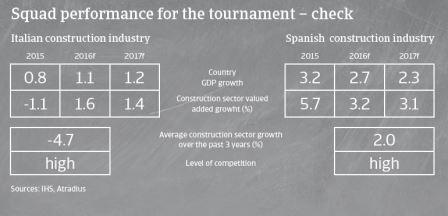

Despite a rebound in both the Italian and Spanish construction sectors payment duration is still long and insolvencies levels remain elevated.

European Football Championship 2016

Sector playing field: construction industry

In contrast to the Squadra Azurra not yet fully recovered

The Italian construction industry was severely affected by the economic downturn in recent years, with yearly GDP contractions between 2012-2014. Since 2008, Italian construction lost nearly 50% of production value and 69,000 employees due to the economic slump, decreased public spending, declined private investment and a profound credit crunch. Small and medium-sized businesses focused on residential construction were most severely affected by the decline, due to decreased investment in private housing and restricted bank loans.

The summer 2014 World Cup was a low point for the Italian football team, which dropped out in group phase, but has rebounded since then with an impeccable qualifying campaign for this tournament. Since the end of 2014 deterioration in the Italian construction sector started to slow, as the economy rebounded modestly. In 2016 and 2017 construction value added growth is expected to increase modestly after years of steep contraction. However, market indicators remain negative for investments in public housing and public infrastructure spending.

Banks are still very restrictive when it comes to providing loans to construction businesses, while loans for private housing projects also remain subdued – although the European Central Bank´s Quantitative Easing programme is addressed to inject liquidity and encourage investments. Many businesses in the sector remain highly geared.An upswing, but the team performance remains shaky

The Spanish construction sector´s contraction bottomed out in 2015, with a 0.3% contribution to GDP growth. In 2016 a robust output growth of about 4% is expected, followed by 5.5% in 2017. This upswing is due to Spain´s economic recovery, more foreign investments and a return of business confidence. Lower commodity prices have also had a positive impact on the current rebound. However, it must be said that the current construction recovery comes after a very low level following years of severe recession, and the market has not yet fully consolidated, just like the Spanish team has regained strength again but still has some weaknesses, as recently exposed when missing to win their group.

Competition in the industry has ceased, as a large number of players have left the market since 2008. In 2015 construction businesses’ profit margins improved slightly, and this positive trend is expected to continue. Spanish residential, non-residential construction and civil engineering are highly dependent on bank funding. In this respect, conditions for external financing have improved in 2015 due to lower country risk and better growth prospects for the Spanish economy.

Players to watch

Italy

Just like the Squadra Azzurra´s defence, most large construction companies have proved to be resilient due to their portfolio diversification of infrastructure works and export orientation.

According to the Italian construction association ANCE, sales/purchases contracts in the residential construction segment increased 20.6% year-on-year.

Construction cooperatives and consortiums focused on the domestic market and dependent on public works have been severely hit by deteriorating demand and decreasing bank loans.

According to ANCE, in the period January-May 2016 public bids declined 11% in volume and 28% in value year-on-year after increasing in 2015.

Spain

Residential construction is expected to grow by more than 4% in 2016 and 2017 due to increasing demand in big cities such as Madrid and Barcelona. However, a volatile job market could weigh on demand.

Commercial construction is expected to grow by more than 2% in 2016. The key to a real improvement in this segment will be the recovery of enough demand from the commercial sector (shops and offices) to justify the launch of new projects.

Public construction experienced a revival in 2015. However, a continuation of the current political uncertainty with a hung parliament could affect investments. At the same time, there is still a great deal of uncertainty about any new government´s infrastructure development plans for the future.

Major strengths and weaknesses

Italian construction industry: strengths

Spanish construction industry: strengths

- Larger players benefit from export demand

- The solid rebound of the Spanish economy is forecast to continue

- Currently low interest rates

Italian construction industry: weaknesses

Spanish construction industry: weaknesses

- Still weak domestic demand

- Restrictive bank lending

- Smaller businesses lack financial resilience

- Lending conditions have not yet fully eased

- On-going political uncertainty has hampered construction investment

- Many businesses active in residential and commercial construction are still highly indebted

Fair play ranking: payment behaviour and insolvencies

Italian construction industry

Trade payables and receivables days are expected to remain long, with no remarkable improvement in liquidity and in the payment performance of the industry.

Payments from public bodies are an issue, with an average payment duration of more than 170 days and unpaid bills amounting to EUR 8 billion in 2015.

Construction insolvencies still increased in 2015, among them three established building consortiums. Business failures are not expected to decrease substantially in 2016 and to remain on a historically high level.

Cooperatives and SMEs focused on domestic residential construction remain highly exposed to the risk of business failure.

Spanish construction industry

Payments still take more than 100 days on average, as construction has always shown longer payment periods compared to other sectors.

However, in the last two years we have seen a slight reduction in payment duration, and no increase in payment delays was recorded in 2015.

Construction insolvencies decreased by more than 20% in January-September 2015. Due to lower leverage of businesses and the positive growth outlook, we expect business failures to decrease further in 2016, by about 10%-15%. However, these follow sharp increases during the crisis years, meaning that the insolvency level remains elevated.

Documentos relacionados

2.98MB PDF